More Institutional Investors Are Buying into the Sector, CoStar Analysis Shows

CoStar Group | Richard Lawson

Real estate investors are taking more interest in medical office buildings as higher prices and risks in other property types have squeezed annual returns, according to a CoStar analysis.

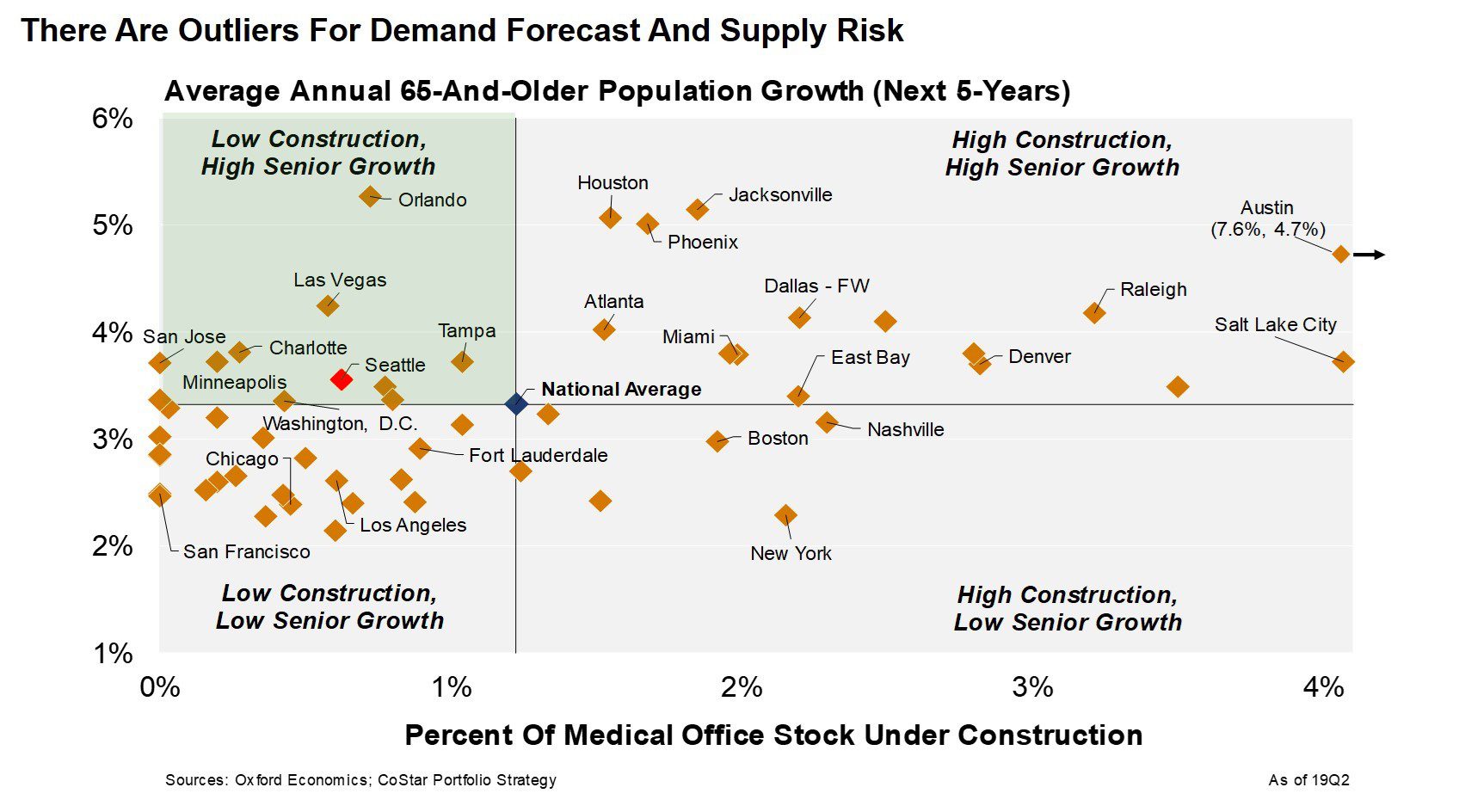

The report, titled “Investing in Medical Office: Just What the Doctor Ordered,” shows the cities with the fastest-growing population of seniors combined with the least amount of competition for tenants or medical office construction underway.

Medical office sales rose 10% to $17.5 billion this year, 2.7 times higher than the peak prior to the last recession, as more institutional investors took interest.

About $4.5 billion of sales over the past year were for portfolios of more than 50 million square feet, which is a big increase over previous years and indicates larger funds.

Private investors and doctors own a bulk of the medical office space, with real estate investment trusts representing the largest share of institutional ownership. Some of the largest holders of medical office space include Healthcare Trust of America, Ventas and HCP.

Population Growth

The 65-and-older population is expected to “grow by 17 million people over the next decade, expanding nearly five times faster than the overall population,” the report notes. That age group, which comprised 13% of the population in 2010, will make up 20% of the population by 2029.

The older population visits the doctor about twice as often as younger people and has the highest level of healthcare spending.

Construction

Medical office construction hasn’t matched demand despite the record length of the current economic expansion. About 25 million square feet of medical office space was built annually at the peak prior to the last recession.

Only 9.3 million square feet has been built over the past year. “At 1.2%, the share of medical office inventory that is underway is well below traditional office, which sits at 2%” as of the second quarter this year, the report says. “In fact, the share of traditional office stock underway surpassed that of medical office in 2014 for the first time since 2002, and the gap continues to widen.”

Developers and institutional investors have favored “trophy” traditional office space and projects with a mix of residential and retail in urban areas.

Much of the demand for medical office space is in the suburbs, according to the report.

“Medical office is still a niche property type,” report said.

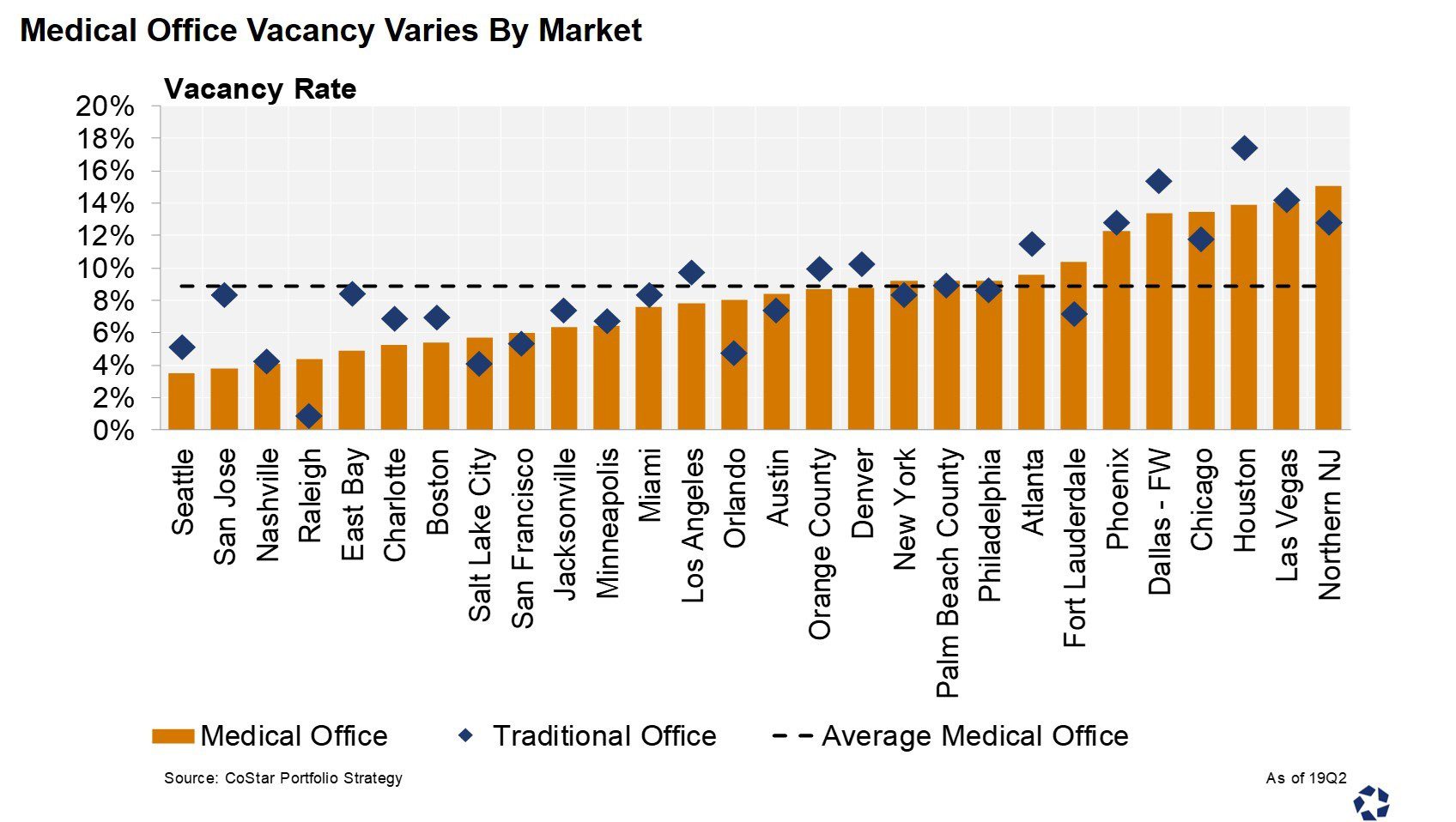

The cities with the lowest medical office vacancy rates are Seattle; San Jose, California; Nashville, Tennessee; and Raleigh, North Carolina, according to the report. (CoStar)

A lack of significant building has kept vacancy rates in medical offices lower than traditional office space and has helped drive up rents. The cities with the lowest medical office vacancy rates are Seattle; San Jose, California; Nashville, Tennessee; and Raleigh, North Carolina, according to the report.

Though traditional office rent gains can be stronger, the report notes that medical office’s rent growth is steadier and less volatile. New buildings can command rent premiums, which hit an all-time high of 14% over rents in older properties.

“Developers should find little resistance leasing-up and can charge rents well above that of older buildings,” according to the report.

• • •

ORION Commercial Partners is currently representing three unique Medical Office spaces for sale in the highly sought-after, low vacancy Kirkland and Bellevue areas. Three medical condominium spaces with diverse investment opportunities:

- Owner/User Medical Office Condominium, Bellevue

- Established Ambulatory Surgery Center Condominium, Bellevue

- New 10-year NNN Lease High-end Tenant Buildout, Kirkland

For more information about these opportunities, contact brokers:

| Scott Clements | David Butler |

| Vice President – Investment Sales | Vice President – Investment Sales |

| P 206.445.7664 | C 206.793.1074 | P 206.445.7665 | C 425.890.7919 |

| sclements@orioncp.com | dbutler@orioncp.com |

Read Original Article Here